|

||||||

|

|

The Basics of Workers Compensation Insurance Premiums

In most states, most employers are required to handle their statutory workers' compensation liability by purchasing an insurance policy. If a company is large enough, many states allow an employer to self-insure this liability, and those particular requirements vary considerably state by state. But generally, this option is only viable for employers with very large payrolls in a particular state. Most employers need to buy an insurance policy to cover this exposure. (Texas is a notable exception to this, in that this state does allow employers to "go bare" without penalty, although it is not generally recommended.) So How Does An Insurance Company Calculate Premiums for Workers Comp? Workers Compensation premiums are, at their most basic, payroll times a rate, adjusted by a past loss history factor.

The basic method of pricing such insurance is a rate per hundred dollars of remuneration. (The most common element of which is payroll, but sometimes it can include other payments or compensation to workers.) So an insurance company starts by asking how much payroll a company has, and what kind of work the company does. The kind of work done will indicate to an insurance underwriter what classification codes to use for a business. There is a unique classification system used for Workers Comp insurance that doesn't directly correspond to any other classification system (like SIC Codes.)

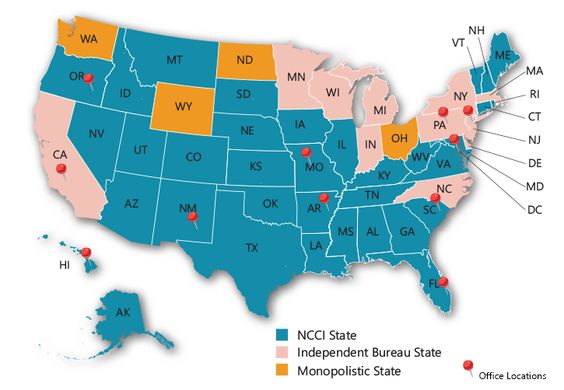

There are different classifications which apply to different work exposures, and each classification will carry its own particular rate per hundred dollars of payroll. The theory is that the rate should vary to reflect the varying exposure to injury of different kinds of work. For example, a bank teller is normally subject to considerably less workplace risk of injury than is a steelworker, thus the rate for the bank teller's classification code will be much lower than the rate for the steelworkers' classification code. But the details of determining the proper classification for many businesses can be less straightforward than the above example. Most states use the NCCI classification system, but a few use systems that are either distinctly different (Pennsylvania and Delaware) or modified significantly (California.) Some states use what are known as independent state bureaus, like Indiana, Wisconsin, New York, New Jersey, and some others shown below. These states use classification systems fairly close to the NCCI classification system, but there can be significant variations for some particular classifications. A few states, like Ohio, Washington,Wyoming, and North Dakota, don't allow insurance companies to handle Workers Comp at all--it has to be done through a state-administered fund. These are known as Monopoly Fund states, and their classifications systems can be unique--although Ohio now uses the NCCI classification system. Typically there are hundreds of different workplace classifications approved for use in a particular state.

But for most employers, only a few classification codes will apply. The guiding classification principle in Workers' Compensation insurance is that the overall business enterprise of the employer is classified, not the individual workplace exposures of employees. For instance, in a manufacturing plant, the janitor isn't classed into a janitorial classification, but rather is placed into the classification used for the shop employees. The classification used for the business is called the governing classification. This is the classification that generates the most payroll for an employer. But there are a couple of workplace exposures that are normally broken out into their own classifications: clerical, outside salespeople, and often (but not always) drivers. These are called Standard Exceptions.

But there are also exceptions made for certain kinds of employers. Generally, employers in construction-type classifications can have payroll of individuals divided among multiple classifications, if records are kept of actual time in each kind of work. So for construction type work, the individual exposures of the workers are classified, according to the classification rules that apply in that particular state.

When you take the rate for a classification and multiply it by payroll (per hundred dollars) you get the manual premium. The manual premium may then be adjusted by an experience modification factor, based on prior loss experience of an employer. This factor, known as an experience mod, X-Mod, or just mod, is specifically calculated for a particular employer, and is revised normally on an annual basis.

There may also be some discretionary adjustments made to the premium if the policy is not in an Assigned Risk Plan. Assigned Risk Plans, sometimes known as the Pool, (or the residual market by insurance people) are a mechanism set up by individual states so that employers can obtain workers' compensation insurance even when insurance companies are not willing to write such insurance on a voluntary basis.

Finally there will normally be a premium discount given. This is simply a size discount, based on the size of the premium. But Assigned Risk policies typically don't give Premium Discount. This is one of the ways Assigned Risk policies end up being so much more expensive than "voluntary market" policies.

Remember also that workers' compensation insurance is written initially on an estimated premium basis. This is because it's impossible to know ahead of time exactly how much payroll will be generated over the course of the policy. Thus, after the policy ends there will normally be some kind effort made by the insurance company to determine the actual payroll for the policy period, and to adjust the premium based on these revised payroll numbers.

If the policy premium is relatively small, the insurance company might just ask the employer to report the actual payrolls. If the policy premium is larger, the insurance company will probably want to send out a premium auditor to determine actual payrolls. After actual payrolls are known for the policy period, an audited premium will be billed by the insurance company. It isn't just the payroll that sometimes gets changed, though. Sometimes, the insurance company will make other changes when figuring the audited premium. Sometimes the insurance company makes changes that make the audited premium bill much, much higher than the original estimated premium. We call those Shock Audits. More about those here.

There can be further adjustments made to some kinds of Workers' Compensation insurance policies based on the losses of the particular insured company. Such Loss Sensitive plans come in several different varieties, such as Sliding Scale Dividend plans, Retrospective Rating Plans (or Retros), Retention Plans, Deductible Plans, and even combinations of these plans. What all of them have in common is that the final premium is further adjusted based on losses. Many (but not all) of these plans make their adjustments on the basis of incured losses, which are actual paid claims plus reserves set by the insurer. Careful attention needs to be paid to the insurer's claims handling and reserving when an employer chooses such a plan, as poor claims handling by the insurer can inflate the premium significantly. Back To Our Online Guide to Workers

Comp Insurance Consultants on Workers Comp Classification Codes, Experience Modifiers, Payroll Audits, & More We've been helping employers since 1987, making Advanced Insurance Management one of the oldest and most experienced firms in the field of premium recovery.

|

|